The New Landscape for Competitive Transportation Grants– A Survey of the Infrastructure Investment and Jobs Act of 2021

With the recent passage of the bipartisan Infrastructure Investment and Jobs Act (IIJA), funding will be greatly expanded for investments across a wide range of infrastructure types, and to address multiple new and/or elevated priorities beyond just expanding capacity and making systems nominally more efficient. This first in a series of several insight pieces on the new infrastructure legislation, specifically addresses the expansion of existing, and creation of new, competitive grant programs within the transportation sector.

Competitive grants are highly time sensitive, and Notices of Funding Opportunities (NOFOs) have already begun rolling out in early 2022. Moreover, such grants often require very specific types of analyses to compete. Therefore, we are providing information to assist potential grant applicants by focusing on how much new funding is available, what the key provisions of these programs are, and what types of analyses will be needed to win grant awards. Regarding the latter, we are providing our opinion of whether traditional benefit cost analysis (BCA) will be needed to support applications as well as what other types of analyses will likely be needed. These may include improved assessment of distributional effects, wider economic impact assessments, and/or enhanced accessibility analysis. Generally, the legislative language does not explicitly say “BCA required,” but the selection criteria will often imply a BCA of some type (note that the types of benefits to be scrutinized can vary from program to program).

It’s worth noting that some major grant programs that have been around for a long time, such as the transit New Starts and Core Capacity programs and Bus and Bus Facilities grant programs. These are largely competitive but are awarded based on limited cost effectiveness criteria, such as ridership increase or condition of assets. Other longer-standing federal funding programs, such as the Congestion Mitigation and Air Quality Improvement Program (CMAQ), are directed to states by formula but administered and allocated to projects by DOTs and MPOs. We do not focus on these older programs in this Insights article. However, it is important to note that older transit grant programs are being funded very robustly in the new legislation; for example, Capital Investment Grants for transit (New Starts, Small Starts, and Core Capacity programs) will receive up to $23 billion, while bus programs will receive about $8 billion. Amtrak and intercity rail programs are also receiving much increased funding; intercity rail will see about $66 billion in new funding, with about a third of that going directly to Amtrak for Northeast Corridor and other network improvements.

|

Changing Priorities

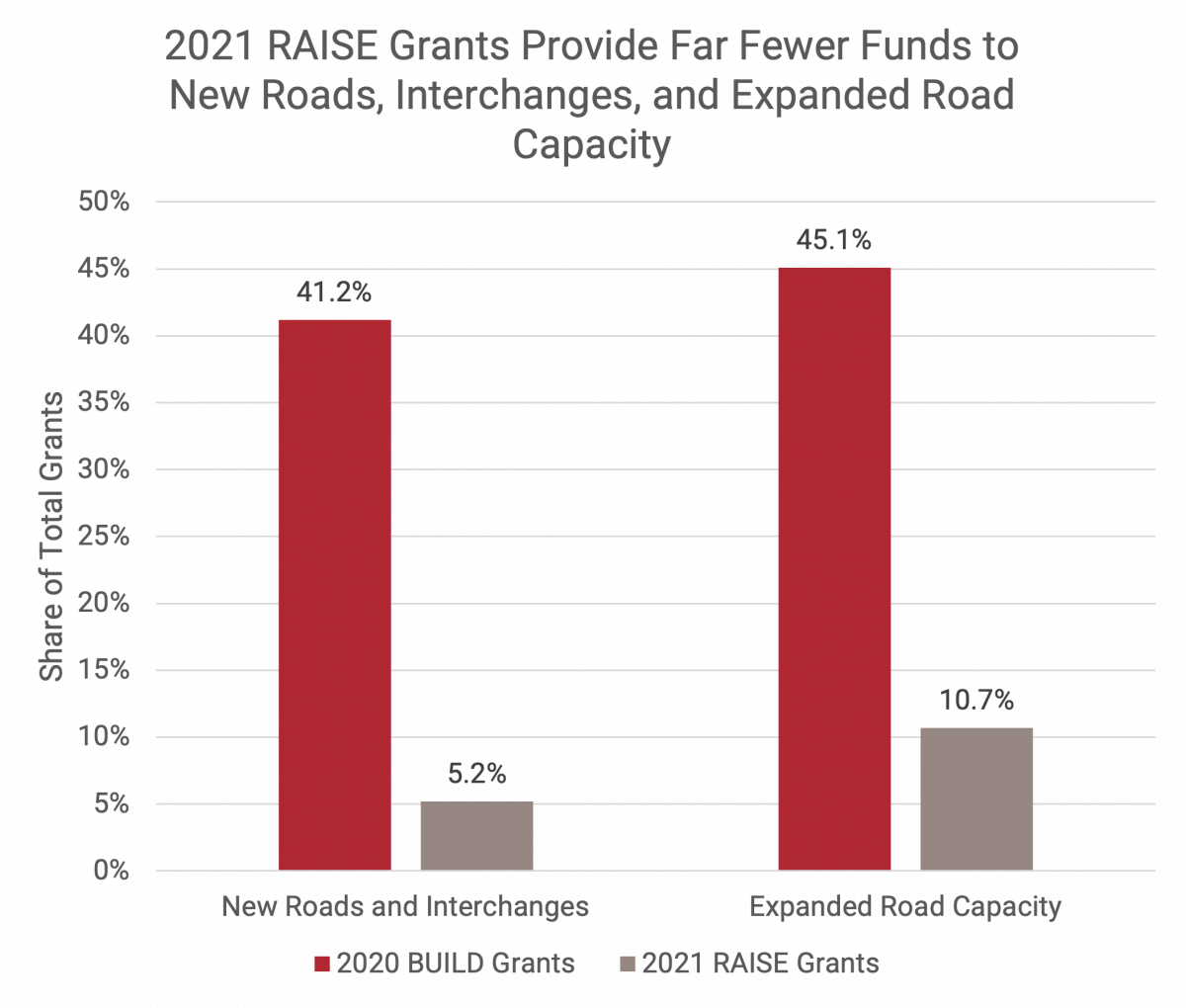

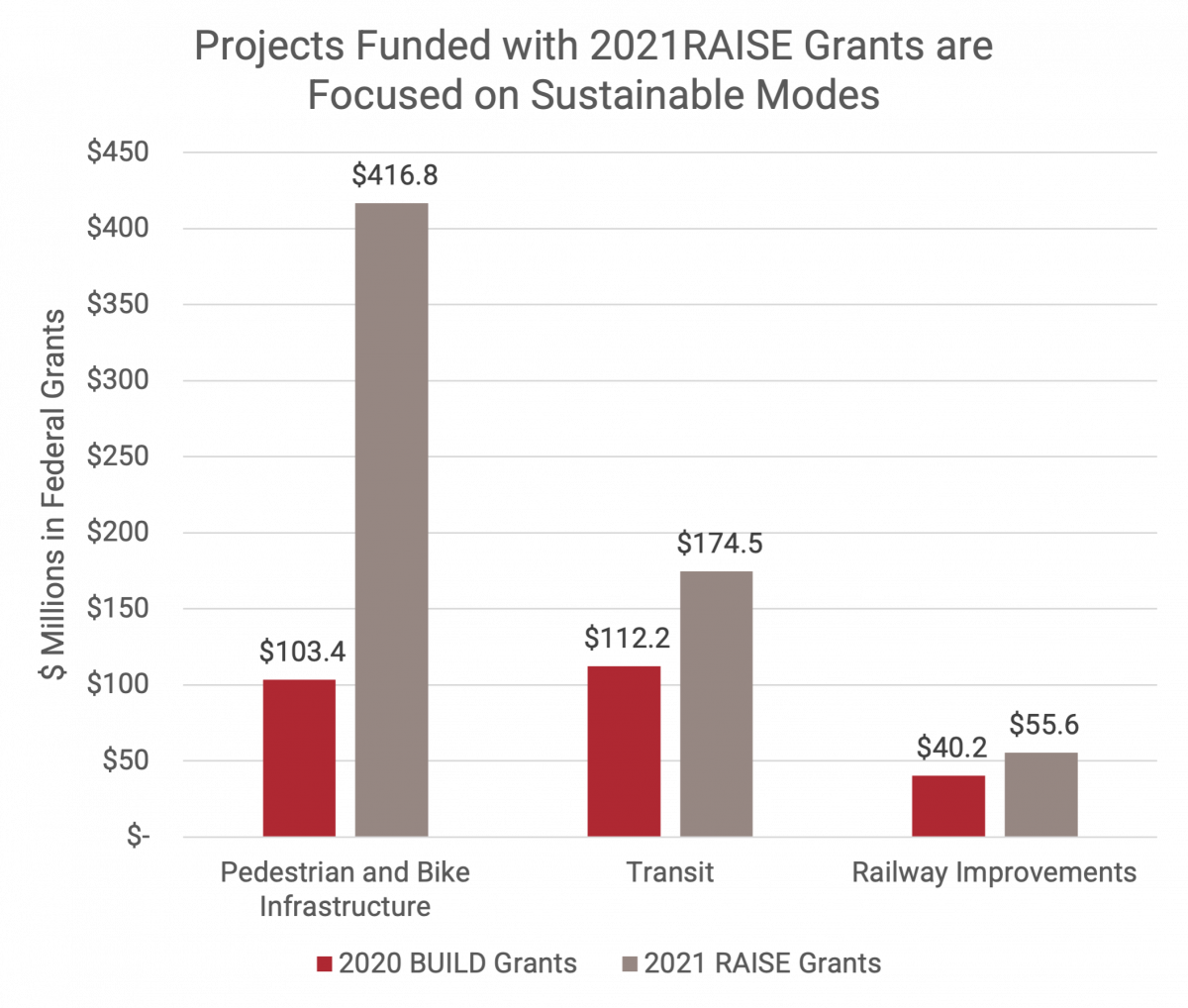

Since the initial TIGER program in 2009, competitive grants for transportation have been focused on an important but limited set of priorities, typically operating within modal “silos.” For example, the initial TIGER grant program, which has evolved over time and gone through several different names (called BUILD between 2018-2020 and then RAISE in 2021), saw a significant reversal in priorities even before passage of the IIJA. Earlier grants went overwhelmingly to road projects. However, in 2021, that changed. A recent analysis by Yonah Freemark of the Urban Institute found that as late as 2020, about 85 percent of BUILD grant funds went to either new roads and interchanges or to expanded road capacity projects. In 2021, only about 15 percent of RAISE funds went to road projects. Non-highway funding has increased about fourfold overall, and within the non-highway category the greatest increase by far has gone to complete streets and greenway projects, including bike and pedestrian enhancements. This shift in funding allocation is consistent with the Biden Administration’s stated priority of emphasizing more sustainable modes and funding historically underinvested communities

Figure 1. Shifting RAISE grant funding allocations, new and expanded road capacity.

Figure 2. Shifting RAISE grant funding allocations, multimodal applications

Source: Yonah Freemark, https://twitter.com/yfreemark/status/1461689868157964288?s=20

The IIJA has codified and greatly expanded these non-traditional priorities on a long-term basis, and this extends throughout the legislation to both old and new competitive grants and formula programs. Many existing formula programs will see large increases in funding and expanded eligibility for projects that incorporate elements such as EV charging infrastructure, resiliency features, and investments in low-income communities. For example, the CMAQ Program and the Surface Transportation Block Grant program now make EV charging infrastructure eligible for grant funding. Summaries of overall funding in the IIJA can be found on various websites, such as the AASHTO, and other organizations.

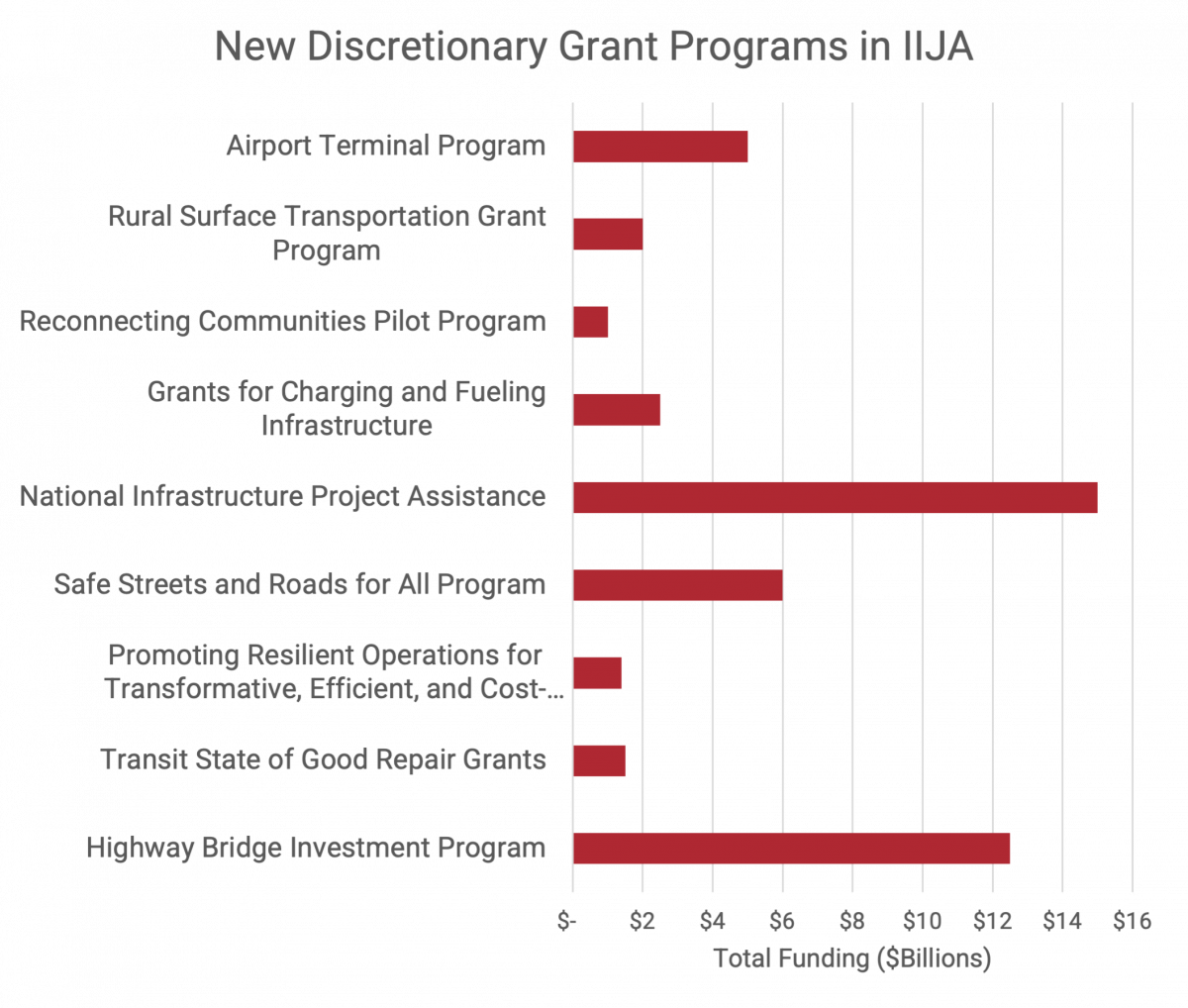

New Competitive Transportation Grant Programs

The first graph below, developed by EBP’s Tess Ruderman, presents a summary of the most important new competitive transportation grant programs found in the IIJA. It highlights the 5-10 year funding amounts for each of these programs and indicates which ones will likely require BCA. Some new but relatively small (in dollars) grant programs, such as the Healthy Streets Program, the Enabling Middle Mile Broadband Infrastructure program, and several others are not shown.

It is important to note again that the graph entries represent competitive discretionary grant programs only – they do not include formula funds within the various functional categories. For example, while there is a new discretionary grant program for bridges, the Highway Bridge Investment Program at $12.5 billion, there are an additional 27.5 billion in formula funds for bridges. To see more details in tabular form about these programs, including primary criteria and minimum and maximum grant sizes, click here.

These are the largest of the new competitive grant programs:

- Highway Bridge Investment Program, $12.5 billion, BCA required

- National Infrastructure Project Assistance, $15 billion, BCA required

- Safe Streets and Roads for All Program, $6 billion, no formal BCA

- Airport Terminal Program, $5 billion, no formal BCA

Graph 1. New Discretionary Grant Programs in IIJA.

Source: EBP, based on review and analysis of IIJA documents and websites

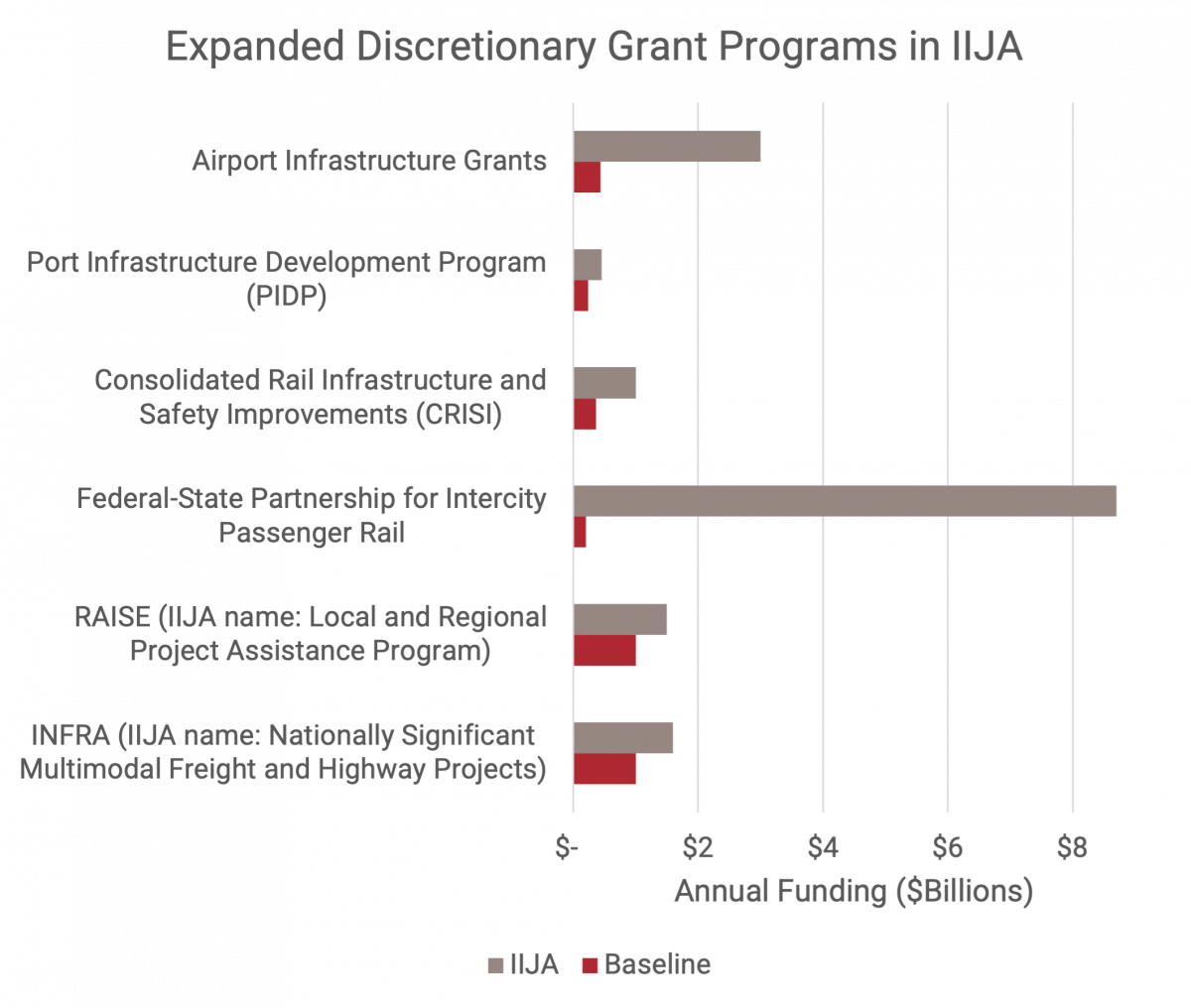

Existing (Expanded) Competitive Grant Programs

Graph 2 lists grant programs that have been in existence previously; most of these will be familiar to those who have been active in “grantsmanship” in prior years. To see this data in Table format, click here. The BCA requirement will almost certainly be continued for the traditional grant programs, including:

-

Nationally Significant Multimodal Freight and Highway Projects (formerly INFRA), $8 billion

-

Local and Regional Project Assistance Program (Rebuilding American Infrastructure with Sustainability and Equity or RAISE), $7.5 billion

-

Federal State Partnership for Intercity Passenger Rail, $43.5 billion

-

Consolidated Rail Infrastructure and Safety Improvements (CRISI), $5 billion

-

Port Infrastructure Development Program (PIDP), $2.25 billion

Graph 2. Existing Discretionary Grant Programs with Amplified IIJA funds.

EBP Grant Support Resources Lead to Successful Outcomes for Applicants

EBP has a long history of providing BCA and economic impact analysis services to support competitive grants. We have supported many successful grant applications that have been awarded a total of $200 millions since the inception of the discretionary grant programs in 2009. Most recently, EBP provided BCA, economic impact analysis, and general grant application support to two port projects that were awarded 2021 PIDP grants. The U.S. Department of Transportation announced on December 24th the award of more than $241 million in discretionary grant funding for 25 projects to improve port facilities in 19 states and one territory through the Maritime Administration’s (MARAD) Port Infrastructure Development Program (PIDP).

The two projects are:

- Bay St. Louis, Mississippi Port Bienville Rail Storage Yard (awarded $4,140,000): This project will construct a new rail storage yard to support the existing operations at the port facility. The project would add 130 additional storage spaces, so that it can safely manage the current storage operations, address the current unmet storage demand, and increase future rail mode share.

- Alpena, Michigan Improving Vessel Access for Sustained Viability (awarded $3,751,623): The City of Alpena is partnering with Lafarge Alpena to upgrade and modernize Lafarge Alpena’s port and landside shipping facilities to meet the increasing demand for the plant’s construction products. Project improvements include berth dredging to increase the water depths within the port basin to satisfy larger vessels, as well as other dock and storage yard improvements. The project will result in multiple benefits, including a significant reduction in vessel calls due to larger ships. Allowing for larger vessels will result in significant expansion of throughput capacity, while lowering unit costs of shipping materials needed for production at the plant.

EBP has the experience and resources to assist competitive grant applicants in winning funds to enhance their strategic programs and help meet their future development goals. In addition to our demonstrated success in winning traditional competitive grants, we are uniquely qualified to apply these services to areas of emerging focus such as complete streets, sustainability, and resilience. Our insightful BCA and economic impact analysis experience demonstrates how complex projects capture multiple benefit streams. For example, we recently pioneered new expanded methodologies that are directly germane to some of the largest new grant programs; for example, EBP’s study for APTA, Assessing the Business Case for Intercity Passenger Rail Corridor Investments, provides a broad-based new evaluation tool that could prove valuable in assessing grant applications under the new intercity passenger rail grant program.

To learn more about EBP’s BCA work, and its associated grant support team and services, please click on this link.