Update & Expansion of the Financial Impacts of RUC on Urban & Rural Households

In an evolving climate of vehicle electrification and improved fuel efficiency largely concentrated in urban areas, legislators, state DOT leads, and everyday drivers need to be aware of alternative options to collecting transportation revenue.

The current collection mechanism, state fuel taxes, disproportionately impact drivers who drive long distances in less fuel-efficient cars, which typically includes rural drivers. RUC America member-states sought to understand how household payments changed for drivers living in different geographic areas under a road usage charge (RUC). Member-states additionally wanted to know how these results could best be communicated to legislators to advocate for fair and equitable vehicle revenue policy, and to constituents to demystify the RUC and dispel common myths associated with road usage charges.

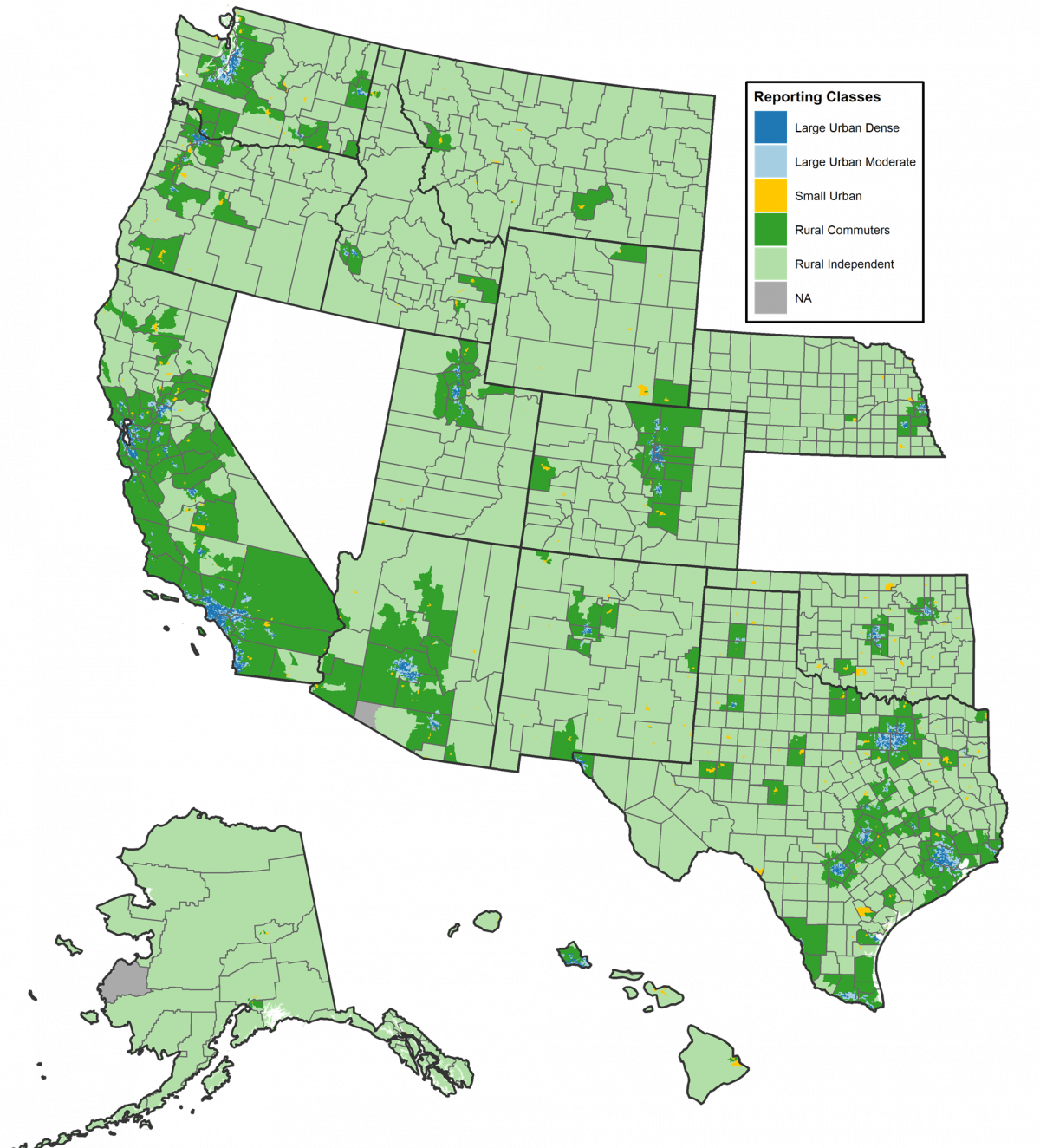

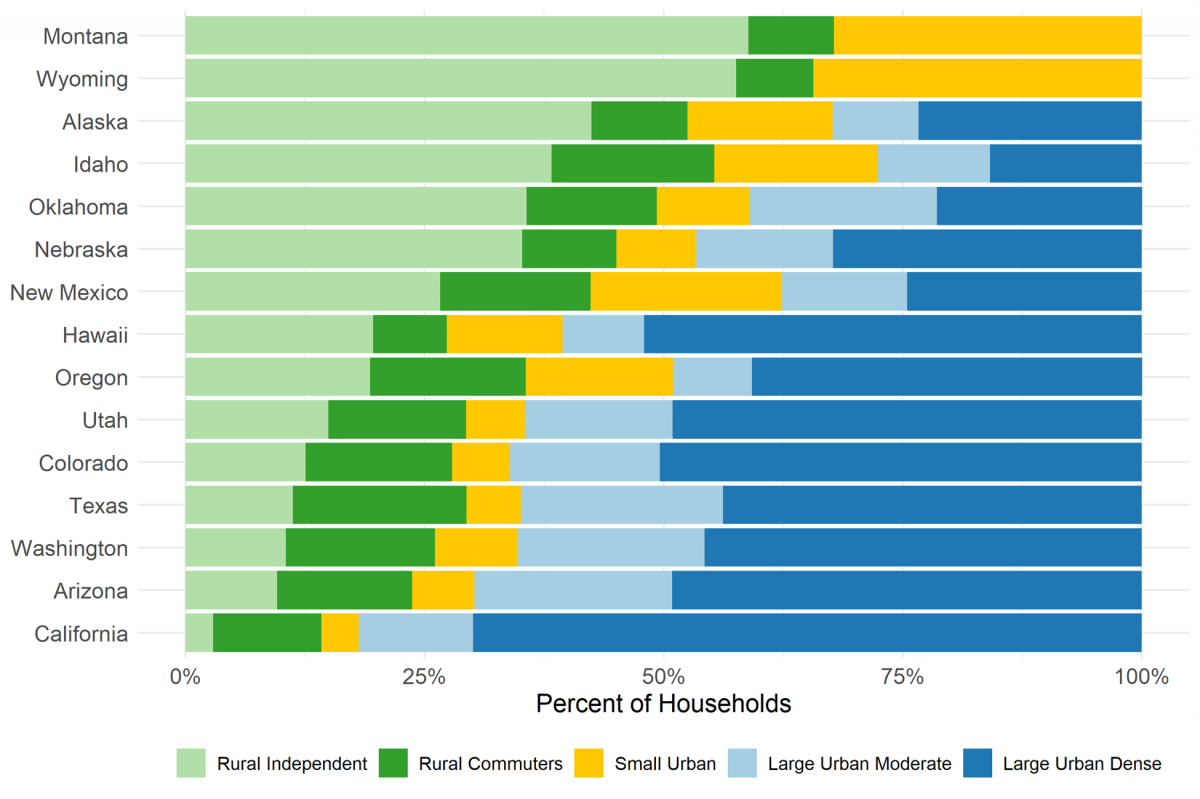

In response to a RUC analysis conducted five years prior by EBP, our firm was tasked with updating and expanding the previous analysis to incorporate additional states and to see how geographic RUC impacts changed over time. For 14 RUC America member-states (AK, CA, CO, HI, ID, MT, NE, NM, OK, OR, TX, UT, WA, WY), EBP estimated how household contributions to transportation revenue would change in different geographic groupings if a state were to transition from current fuel taxes to a revenue-neutral, distance-based, road usage charge.

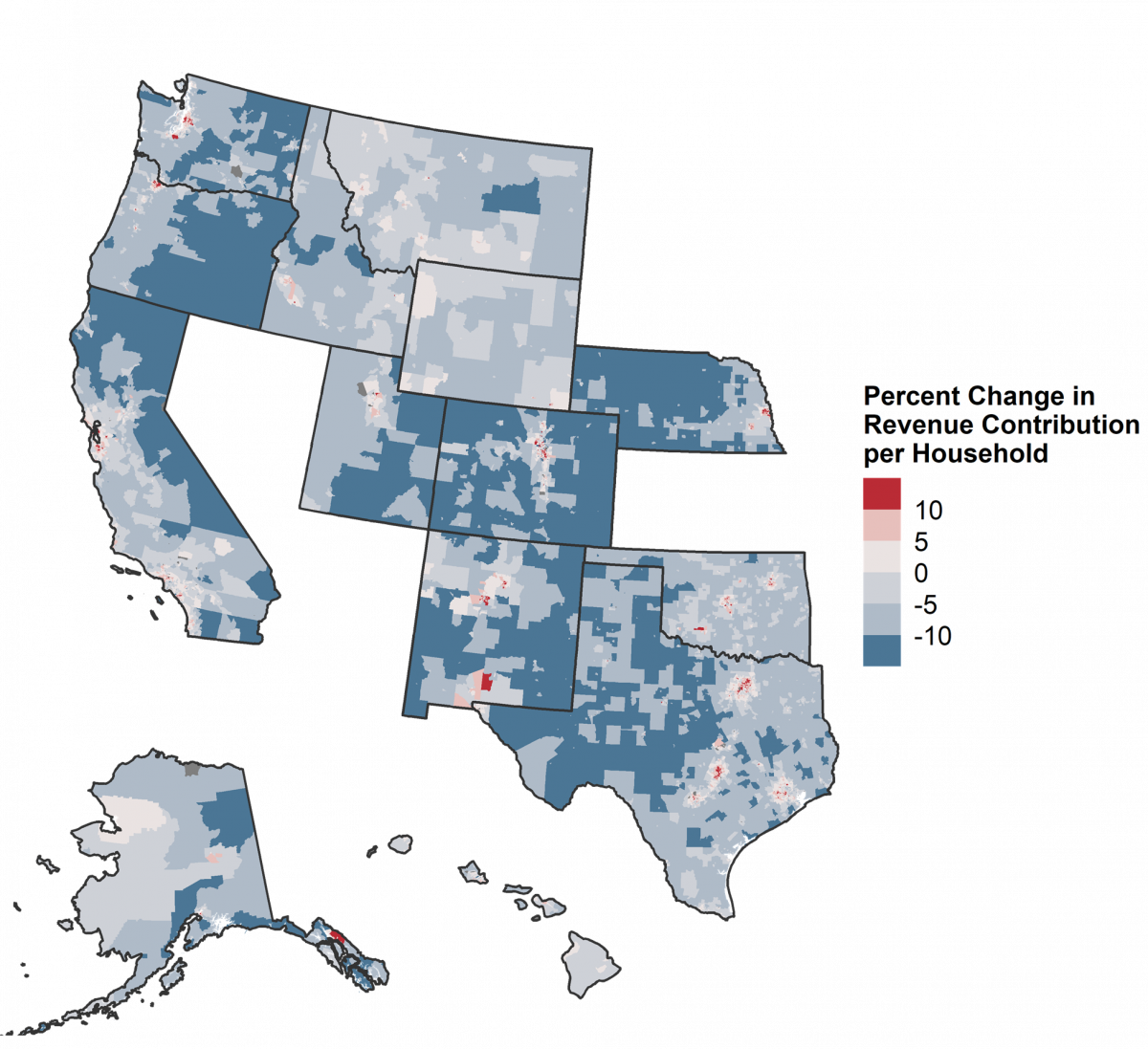

The revenue change estimate was made at the census tract level based on collecting VIN and address information from registration records, decoding it using EPA fuel economy data and NHTSA vPIC data, and joining it with estimated travel behavior data from LATCH (an NHTS product) at the household-level. Analysis of the current vehicle fleet was compared to the fleet of five years ago using previously collected data for nine of the 14 states to investigate how adoption of high efficiency vehicles had progressed over the past five years, and how that affected spatial patterns of revenue policy incidence.

The key findings of the report include the following: 1) under a RUC policy, the revenue burden for rural drivers decreases relative to the revenue burden for urban drivers, and 2)the gap between what rural and urban drivers pay in fuel taxes compared to potential RUC revenue is increasing overtime. As part of the project, EBP provided a presentation of findings to the Oregon Road User Fee Task Force (RUFTF) in July 2022, and to the RUC America Steering Committee in November 2022.