Supporting Economic Development Using Value Capture to Fund Transportation

There is a perceived tension between value capture and economic development, but there doesn’t need to be. The two are not naturally at odds with one another.

Forthcoming, there are examples of how value capture can be used to support economic activity and job growth, but first, it is important to understand each of the two pieces - economic development and value capture:

Economic Development. State and local economic development agencies tend to approach economic development from an incentives perspective: What carrot could we offer to retain existing businesses? To encourage them to grow? To attract new companies to the jurisdiction? But companies are not fish waiting to strike at a shiny lure. They have a sophisticated understanding of their business needs, and can accurately compare the true costs of doing business among competing locations. While incentives can help at the margins, perhaps by filling gaps in access to credit, shoring up workforce training, or providing small business technical assistance, they are at best the tip of a vast iceberg of factors that affect a business’s bottom line, most of which cannot (or should not) be remedied through direct incentives.

Transportation costs, accessibility, reliability, and market access affect nearly every aspect of business operations, from site cost and availability, to efficiencies in accessing supplier and consumer markets, to labor costs and access to workers with specialized skills and experience (yes, even with the post-Covid increase in remote work). As a result, a well-functioning transportation system can be a powerful force for economic development. And, because transportation infrastructure creates value, part of that value can be used to pay for it.

The benefits of transportation infrastructure investments do not accrue evenly across the community. Users receive a public benefit of direct cost savings, increased accessibility, improved reliability, and better market access, and this can create spinoff benefits throughout the economy. On the other hand, a small number of property owners and developers receive a concentrated private benefit in the form of increased property values (sometimes called a “windfall”). That is to say, they receive a concentrated private benefit from a public investment. This benefit is worth many times the public benefit others in the community receive. Using our traditional approach to transportation funding, most businesses end up paying for infrastructure that creates private benefits for just a few.

This approach not only results in an uncompetitive cost burden; it is unable to meet transportation funding needs. The current model is based primarily on declining revenue sources—federal and state fuel taxes, tolls, local vehicle registration fees, and parking fees (aka “user fees”)—that starve the system of greatly needed investment. In this environment of declining revenues, communities aren’t getting the infrastructure they need to maintain their existing infrastructure, nor keep up with the pace of growth. The current model is supplemented—primarily at the county and municipal level—by property taxes in the form of general fund allocations. This spreads the cost of an infrastructure investment across taxpayers regardless of how much they use or benefit from that infrastructure.

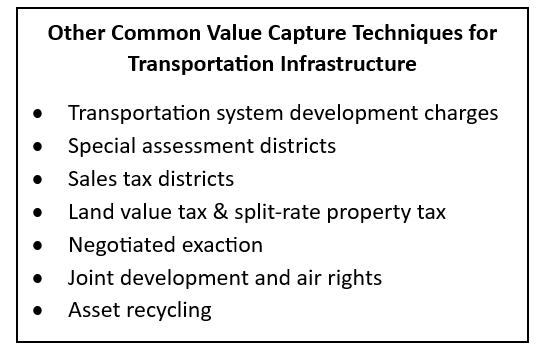

Value Capture. The term “value capture” can be off-putting, so it is sometimes more accurately called land value capture or land value return. It is a collection of revenue generation techniques designed to harness a fair share of the concentrated private benefits created by a public investment. That “value” is then used to fund the infrastructure itself. (Important note: If a so-called value capture program captures privately created value,[1] it’s not really value capture! This includes Tax Increment Financing (TIF), which can be a perfectly valid economic development incentive. It should not be confused with value capture.)

A well-designed value capture program more accurately communicates the true cost of infrastructure and assigns costs across beneficiaries in proportion to how much they benefit. This keeps general taxes lower, or at least proportional to the benefits they generate. And it allows infrastructure spending to keep pace with needs, promoting economic development competitiveness. (It also promotes fiscal and environmental sustainability, but that is a topic for another day.)

An important concept to keep in mind when designing a value capture program is that taxes and fees based on land value have a completely different economic effect than taxes on goods, such as the value of what is built on the land. Land value is primarily driven by factors outside the control of individual landowners such as location (including climate and weather), government actions (e.g., land use, infrastructure), and the actions of other private companies and institutions (e.g., major employers, universities).

While property owners can change the value of what is built on their land, they have little influence over the value of the land itself. As a result, the more closely a value capture implementation is tied to changes in land values—which cannot be manipulated by individual landowners or developers—the less it distorts the real estate market. In contrast, when a tax or fee is tied to what is built on the land, the taxes or fees end up shaping decisions about where and how much to build. It is better for everyone if those decisions are shaped by what people and businesses need. (For the unconvinced or those who want to better understand this principle, this FHWA resource provides an excellent explanation.)

Land value property tax or a split-rate property tax (which taxes land value at a higher rate than building value) are the two value capture techniques that most directly achieve this, but for a variety of reasons, they can be difficult to implement. Instead, many jurisdictions choose to use value capture techniques that approximate a user fee. The more closely the fee is tailored to actual use of transportation infrastructure, the better it functions, as decisions about where to locate a business and where to live can still be made by what businesses and people need, rather than a calculus about avoiding a fee or tax.

The following two examples: Pasco County, Florida’s Multimodal Mobility Fee Program, and Hillsboro, Oregon Transportation Utility Fees, demonstrate how value capture can be used to support economic development.

Multimodal Mobility fees are essentially impact fees that are used to support all modes of transportation, including active transportation infrastructure and transit, and they are designed to support compact, mixed-use “transit-ready” development and business growth. Proposed projects that meet criteria for transit-readiness or job growth pay reduced fees or have fees waived. The program can do this without unfairly spreading the infrastructure costs of these developments to other businesses and residents by using funds from two other sources. These include the Penny for Pasco local option fuel tax, and Tax Increment Financing Districts (used as an economic development incentive, as mentioned above). Pasco County’s program was awarded the Tampa Bay Regional Planning Council’s Future of the Region Award in 2012 as a model for growth management and infrastructure funding.

Example: Hillsboro, Oregon, Transportation Utility Fees (TUF). TUF is a recurring fee, typically monthly, levied by a jurisdiction on all residents and businesses meant to approximate road usage the way a water/sewer fee or electric bill reflects use of that infrastructure. I particularly like TUF because it is intended to be used to pay for roadway maintenance (rather than system expansion), which is so important and something many jurisdictions struggle to fund. As mentioned above, it is key for user fee-type programs to approximate actual road use as best as possible. Hillsboro does this by estimating person trips generated by different land uses or building types, rather than just vehicle trips. This acknowledges lower per-trip costs of pedestrian, bicycle, and transit trips, and incentivizes compact, mixed-use development that provides a host of other economic and environmental benefits. Though TUF is primarily used for maintenance, Hillsboro dedicates about 30 percent of TUF revenues to new bicycle and pedestrian infrastructure, further encouraging compact, walkable land use patterns. (Read more about Hillsboro, Oregon’s TUF here.)

Tools for Using Value Capture to Fund Infrastructure for Economic Development. These are just two examples, but there are many ways to use value capture to fund transportation infra