Road Pricing may be coming: Economists are on board, but will the public be convinced?

Road Pricing may be coming: Economists are on board, but will the public be convinced?

Most people seem to agree with a “user-pays” principle for transportation infrastructure, especially for roads and highways. The fuel excise tax on gasoline and diesel has long been the primary source of federal and state transportation revenues. While economists have long advocated for other types of fees, transportation professionals, policymakers, politicians and even the public have just recently become more active in pricing discussions. A number of trends in transportation technology and behavior have launched this discussion, which was strongly evident this year at the TRB Annual Meeting.

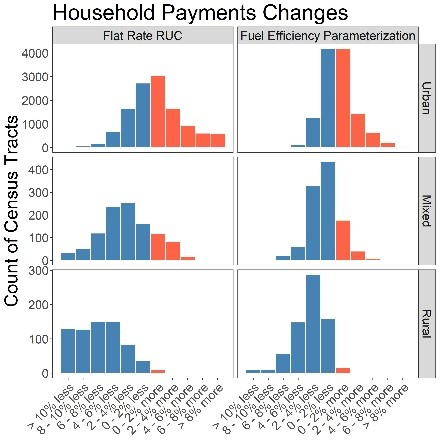

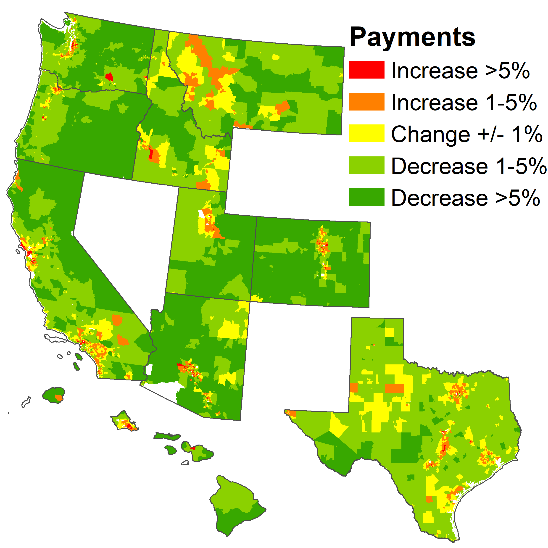

A lot of work that I shared at TRB this year considers how revenue policies might respond to the following trends and what the impacts of those revenue policies would be on household contribution to transportation funding in urban and rural areas respectively.

Trend 2: On-Demand Ride Services and Micromobility. In the past few years, we’ve witnessed an explosion of new mobility options (a topic EDR Group also addressed at the TRB Annual Meeting). This trend has contributed to the pricing debate in a quite different manner from fuel efficiency gains. Cities (and occasionally states) have been involved in developing new policies to charge fees to companies operating new services. Many of these fees are pitched as part of the “user-pays” principle. The idea behind this principle is that ride services, for example, should pay for access to curbs and streets, and scooter and bikeshare companies should pay to rent storage space on sidewalks and support new bike lanes. However, these new fees on emerging services haven’t necessarily been matched by equivalent fees for car parking or space use. Many on-demand ride fees closely resemble congestion charges as well, which has helped normalize this kind of pricing for policymakers.

Trend 3: Automation and Connectivity. Automated driving is probably the biggest change pushing agencies to implement new pricing policies. A completely driverless mobility-as-a-service future may significantly increase the convenience and lower the cost of travel, which we can expect to lead to more and longer trips. Driverless vehicles also raise the specter of zero-occupancy trips and new deadhead miles, with the potential to raise overall urban VMT. At the same time, the high level of connectivity of these future vehicles might provide ideal mechanisms for collecting fees on travel. Connected and autonomous vehicles may help to further reduce the privacy concerns people express today about distance- or time-based user charges.

Response 1: Congestion Pricing. I presented in a session titled “Pricing in the Emerging Mobility Ecosystem,” where a major theme was the ability of congestion pricing to optimize the travel of new mobility fleets. I also enjoyed participating in the Economics Committee’s session “Autonomous Vehicles and Mobility Services: An Economics Perspective,” where much of the conversation focused on using pricing to address the negative externalities of an autonomous future. The entire perspective of AVs leading to negative congestion externalities is a slightly different perspective from the utopian expectations of a couple years ago.

Furthermore, pricing of on-demand ride services provides a great example of how the specter of AVs might lead to real changes and implementation of new policies. Existing TNC airport charges and other location-based surcharges (such as those already in force in Chicago) are essentially congestion cordon charges. The same is true of the policies recently passed in New York City, as the discussion of full-fledged congestion pricing in Manhattan inched closer to reality. Just one day after the end of TRB, FHWA has also notified Oregon that it would consider letting new tolls be implemented on I-5 to help manage traffic under the Value Pricing Program.

As part of our Shared Mobility Options and Incentives Study, EDR Group is working with FHWA to study whether incentive programs could effectively reduce vehicle miles traveled by supporting shared ride services.

This is a rapidly evolving part of our economics practice and something we’d love to talk with people more about. You can reach Kyle Schroeckenthaler at kschroeck@edrgroup.com for more information.