What Do Airports Mean to Regional Economies in a Post-Pandemic World?

What Do Airports Mean to Regional Economies in a Post-Pandemic World?

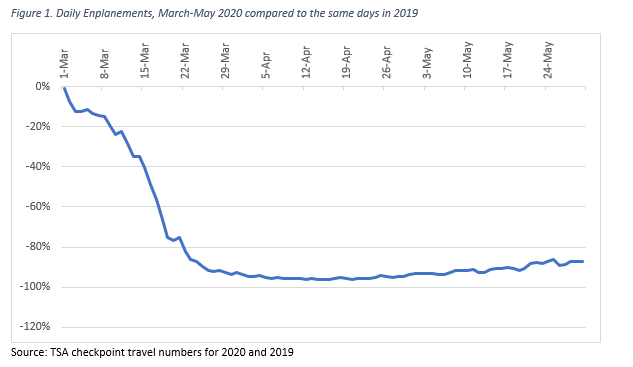

Based on TSA checkpoint counts, enplanements in April 2020 saw a 95% drop from April 2019 levels, and a 91% fall in May 2020 from May 2019 (though May 30). However, as a very slight glimmer of optimism, TSA day counts show that the day by day drop from 2019 to 2020 is less than 90% from May 21 through May 30. This slight uptick offers limited hope for the future industry, understanding that a more than an 80% decline remains severe (Figure 1). As a result, the federal government has permitted service reductions to 75 airports due to low demand. Moreover, according to a report by CNN Business, the first quarter losses for airlines exceeded $2 billion.[1] While the federal CARES Act has stabilized airline employment, that crutch is scheduled to be removed as of October 1 when employment of airlines’ 750,000-person workforce of crew, mechanics and other ground support staff will be vulnerable to the dramatically reduced passenger demand and potential air service restructuring.

For airports and aviation systems, declining passengers means fewer customers for terminal businesses, parking, taxi, and transportation network company (TNC) rides, all leading to lower employment on airport and less revenues generated by these tenants or from fees paid from parking and transportation fares.

How can airports present the value of their services in the wake of the pandemic?

Airports and state aviation bureaus typically document the roles that airports provide in sup-porting jobs, income and business vitality. Such assessments are developed for individual facilities, such as one of the nation’s major hub airports, a small regional system of several airports (e.g., Pittsburgh, Columbus, Houston, Miami, or Phoenix), and/or statewide airport systems. These “economic impact studies” provide information on the role and importance of airports to stakeholders, advisory committees, the broader public and legislative decision-makers.

Typically, economic impact studies are issued every two to five years and are compared with the preceding study to show trajectories in the importance of airports in regional and state economies. Given that the basic elements of these studies are on-airport employment and visitor spending, the resulting economic numbers will likely plummet in the COVID-19 envi-ronment due to declines in airport users and jobs in terminals, airport administration and, after October 1, airline employment. A complicating issue is that the data and multiplier estimations in regional economic modeling systems typically lag current conditions by one to two years. This means that the most current calibrated regional or state input-output mod-els today represent the 2018 economy and next year (2021) will reflect the 2019 economy.

To properly and credibly represent the economic roles of airports in the wake of COVID-19 requires an analytical approach that does not ignore the impacts of the virus. Rather, the aviation community has an opportunity to trace its economic role in the context of the virus and to showcase the resiliency of airports and airport systems. To effectively do so, we sug-gest the following changes in the ways that economic impact studies are addressed at least until air service returns to 2019 levels:

1. Use Monthly and Quarterly Data to Tell a Recovery Story. Traditionally, economic impact studies present annual

2. Engage Airport Stakeholders in Resilience Strategies. An ongoing recovery is an opportunity to describe resiliency measures taken be the airport administration and work with airport stakeholders to development further resilience strategies. Descriptions could be qualitative detailing steps underway and planned or combined with benefit/cost analyses and the observed or anticipated economic impacts from implementing such strategies.

3. Airport managers and FBOs need to be enlisted as allies in documenting the recovery. Airport tenants are typically surveyed once, to account for annual employment in a study year. Similarly, visitors (both commercial and GA) are surveyed once to represent visitor spending. Ideally, airport managers could be enlisted to help track tenant employment changes monthly or at least at the beginning and end of the study period. Such tracking would help illustrate how airports are contributing to growing employment centers in cities, metro areas and communities across states. Similarly, visitors are usually surveyed once to document spending. If possible, scopes of studies should stagger surveys to capture changes, if any, of visitor spending in changing economic environments. In addition, airports and aviation bureaus should not shy away from meta-analyses, combining surveys from multiple airport locations across stages of the recovery with significant airport and local economic characteristics in order to profile changes of the extent of visitor spending.

4. Adjust Economic Models to Reflect True Conditions. It is important that economic models adjusted to reflect actual economic conditions. Making these adjustments is easier with some model packages than others, and the ability to do so may be a criterion for which package is selected for studies. Adjusting a model will affect employment, labor income, and added output as well as affect the multiplier impact from industries supply chains and consumer purchases. Adjustments can be based on state data, which includes a quarterly census of employment and wages or less detailed monthly current employment statistics. State data are available by county, metro area and/or labor market are, but are subject to disclosure rules that can limit its use.

Given the impacts of COVID-19 on airports and across the economies of cities, counties, regions and states, aviation economic impact studies cannot be business as usual. To be an effective tool for communicating the importance of airports, such studies need to show the dynamic relationships of how airports are contributing to the national recovery and how the economic recovery is bolstering the resurgence of air transportation. At the same time, paradigms for leisure travel, business travel, and the hospitality industry are changing across the U.S. Aviation economic impact studies can inform policymakers and the public on what these shifts mean for the economic development of regions and states.

[1] https://www.cnn.com/2020/05/10/business/airline-job-cuts/index.html (accessed 5/31/2020).